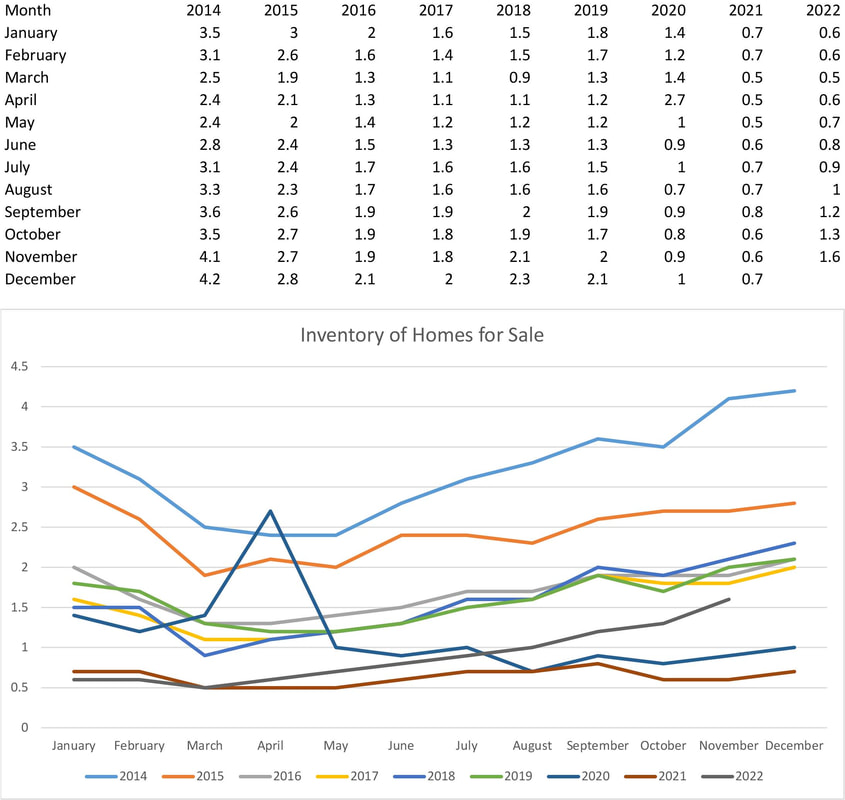

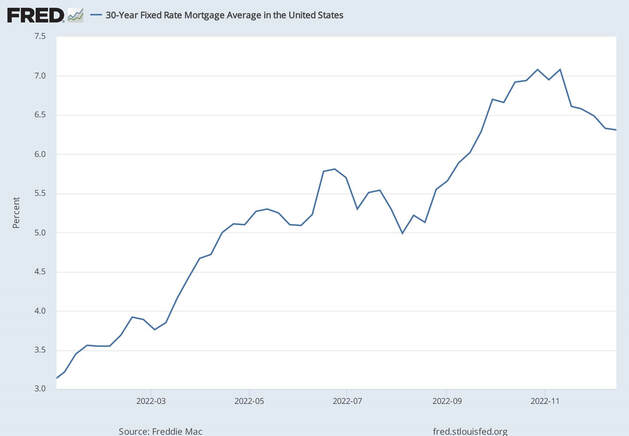

Reading real estate headlines over the last few months, I've seen many click-bait titles that pander to people's fears about a huge housing crash and global recession. However, if you actually read the articles, it doesn't say anything close to what the headline implies. While the market has cooled this year, there is still high demand for housing and short supply. As of stats compiled through the end of November, the greater Grand Rapids area is currently sitting at 1.6 months of inventory. See the chart below for the monthly inventory numbers since 2014. Inventory is a measure of whether the market is a buyer or seller's market. This number is determined by figuring how long it would take to sell through the current number of homes on the market at the current rate they are selling, assuming no new houses hit the market. 5-6 months of inventory is considered a balanced market. Although 1.6 months is three times the amount we had last year at the same time, this number still represents low inventory and a market that favors sellers. Homes under $300k are in especially high demand. If you look at the inventory graph below, 2016-2019 were all very consistent. It was a competitive market back then, and we still have a ways to go before we are back to those levels. Interest rates climbed as high as around 7.2% in November, but then came back down and are currently sitting around 6.3%. The average sale price is $336,577, up 11.2% over last year.

Overall, housing inventory is still extremely low when you look at historical data. In order to obtain a balanced market, we would need to more than triple the current relative inventory. That means prices will continue to increase, albeit at a slower pace than the last two years. The real question I have is how high will inventory actually go? December statistically has the highest inventory and March the lowest when looking at normal yearly fluctuations. I think the rate at which we are gaining inventory will slow once we hit the spring market and demand surges again among buyers. Either way, we will continue to be in a sellers' market for the foreseeable future.

0 Comments

Leave a Reply. |

Lisa VanderLooGreat info on everything real estate. Categories

All

Archives

November 2023

|

RSS Feed

RSS Feed