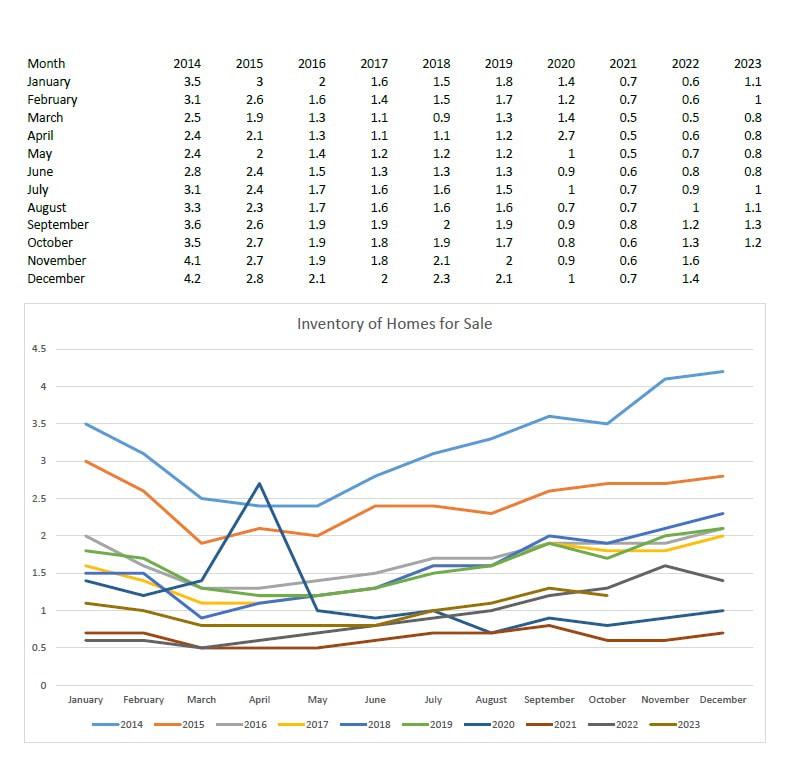

The Grand Rapids real estate market has been incredibly resilient to the change in interest rates. According to Redfin, Grand Rapids placed second in September among the fastest moving metro markets with an average sale time of only 9 days on market. While relative inventory has increased and the pace of the market is not as frenzied as it was the prior two years, inventory still remains low. Prices continue to increase, albeit at a much slower pace. Even though some things have changed, the greater Grand Rapids real estate market still strongly favors sellers. The speed at which interest rates increased over the last year and a half was shocking. At the end of 2021, interest rates were sitting a little above 3%. In 2022, they started increasing and didn't stop until they hit 8% about a month ago. As rates kept increasing, many buyers fell out of the market and a fear of recession started to permeate the real estate landscape. The number of houses sold in November 2022 were down by 26% compared to the same month in the previous year. The relative inventory peaked at 1.6 months. That number still represents a seller's market, but the change felt drastic compared to what had been happening the couple of years prior. It seemed like buyers got used to the new normal of interest rates quickly, though. By spring, inventory decreased back down to 0.8 months. Buyers faced an extreme battle for houses all over again. The real estate market has slowly gained relative inventory over the last few months, but remains tight. The drastic change in interest rates will only further restrain supply since many people are now "stuck" in their homes. They will not move because they want to hang on to that low interest rate. Buying something similar at a higher rate would be a lot more expensive. We are currently sitting at 1.2 months of housing inventory. Interest rates fell back down to around 7.25%. The number of residential sales this year compared to last year is down 15.0%. However, prices have continued to increase and the average sales price is up 5.3% year-to-date. The greater Grand Rapids real estate market will continue to be a seller's market for the foreseeable future. A lot more inventory is needed before things level out. While I regularly attend economic seminars focused on our local area, forecasting the future of real estate is difficult right now because nothing feels normal. Housing Next of Grand Rapids predicts a housing shortage through 2025. They are actively working to address issues that restrain supply. Dr Alan Beulieu of ITR Economics predicts our market will remain steady and prices will keep appreciating at 3-5% per year for the next few years. That is taking into account the US will likely be in a mild recession in 2024. Overall, the Grand Rapids market has been incredibly resilient to the rising interest rates and remains a strong seller's market. Inventory is a measure of whether the market is a buyer or seller's market. This number is determined by figuring how long it would take to sell through the current number of homes on the market at the current rate they are selling, assuming no new houses hit the market. 5-6 months of inventory is considered a balanced market.

0 Comments

Leave a Reply. |

Lisa VanderLooGreat info on everything real estate. Categories

All

Archives

November 2023

|

RSS Feed

RSS Feed